Accounting

| Created by | Borhan |

|---|---|

| Last edited time | |

| Tag |

| Sole Proprietorship | Partnership | Company / Corporation | Public-Private Partnership (PPP) | |

|---|---|---|---|---|

| Definition | A sole proprietorship is a business that can be owned and controlled by an individual. | A partnership is a formal arrangement by two or more parties to manage and operate a business and share its profits. | A company is a legal entity formed by a group of individuals to engage in and operate a business enterprise in a commercial or industrial capacity. | A Public-Private Partnership (PPP) is a partnership between the public sector and the private sector for the purpose of delivering a project or a service traditionally provided by the public sector. |

| Advantages | - Easy to set up and operate - complete control over business decisions, - flexibility in management, - all profits go to owner | - Shared ownership and decision-making - shared financing and workload, -potential for increased expertise and resources, - available tax benefits | - Limited liability - separate legal entity from owners -easier access to capital - perpetual existence - ability to transfer ownership | - Allows governments to tap into private sector expertise and innovation - reduces financial risk - encourages efficiency and cost-effectiveness, and can lead to improved infrastructure and services. |

| Disadvantages | - Unlimited personal liability for business debts and lawsuits - difficult to raise capital - limited expertise and resources, - potential lack of continuity on owner's death or disability | - Potential for disagreements among partners - unlimited personal liability for partnership debts and lawsuits, - difficulty transferring ownership, - potential lack of continuity if one partner leaves | - Higher operating costs - more complex management structure - greater legal and regulatory requirements - potential for conflict between shareholders and management - potential for reduced control by individual shareholders - Double taxation of company profit | - Requires careful planning and management - potential for conflict between partners, - limited control over the PPP's operations, - potential for reduced returns if the project or service is not successful. |

Characteristics of Business

| Characteristics | Details |

|---|---|

| Technology-driven | Businesses are investing heavily in technology to improve efficiency, reduce costs, and enhance the customer experience. This includes automation, artificial intelligence, cloud computing, and big data analytics. |

| Global | The rise of e-commerce, the expansion of international trade agreements, and advances in transportation and communication have made it easier for businesses to operate globally. This presents new opportunities for growth, but also new challenges related to cultural differences, supply chain management, and regulatory compliance. |

| Customer-centric | Customers are more informed and demanding than ever before, and they expect personalized experiences that meet their unique needs and preferences. To succeed, businesses must understand their customers' behavior, preferences, and pain points, and tailor their products and services accordingly. |

| Agile | The pace of change in today's business environment is rapid, and businesses must be able to quickly adapt to changing market conditions, customer demands, and technological advancements. This requires a culture of agility, flexibility, and innovation. |

| Sustainable | Businesses are increasingly focused on sustainability, incorporating practices that reduce their impact on the environment and support social responsibility. This includes initiatives such as using renewable energy, reducing waste, and supporting fair labor practices. |

| Data-driven | Data is a valuable asset for businesses, providing insights into customer behavior, market trends, and operational performance. With advances in data collection and analysis tools, businesses are able to make more informed decisions based on real-time information. |

| Collaborative | Collaboration is becoming more important as businesses work across departments, functions, and even organizations to achieve common goals. This includes collaboration between employees, customers, suppliers, and other stakeholders, with a focus on creating value for all parties involved. Sure, here's a revised table that includes the three types of diversification you mentioned: |

| Government Interference | |

| Competition | |

| Science | |

| Diversification | |

| Change | Modern business is very dynamic |

| Type of Diversification | Definition | |

|---|---|---|

| 1. | Horizontal Diversification | adding new but unrelated products or services for present customer |

| 2. | Concentric Diversification | adding new and related products or services |

| 3. | Conglomerate Diversification | adding new but unrelated products or services for new customer |

| Joint Venture | |

|---|---|

| Definition | An agreement between two or more parties to work together on a specific project or business opportunity, while maintaining separate identities and ownership. |

| Purpose | To pool resources, expertise, and funding to achieve a common goal or objective. |

| Formation | Typically requires a legal agreement outlining the terms of the joint venture, including each party's contributions, responsibilities, and ownership structure. |

| Management | May be managed by one of the parties or through a separate management structure established specifically for the joint venture. |

| Risk and Reward | Each party shares in the risks and rewards of the joint venture, typically based on their contribution to the project or business opportunity. |

| Duration | Joint ventures can be established for a specific period of time or may have no fixed end date. |

| Advantages | Allows companies to leverage complementary skills and resources, reduces financial risk, provides access to new markets or technologies, and can lead to increased innovation and competitiveness. |

| Disadvantages | Requires careful planning and management, potential for conflict between partners, limited control over the venture's operations, and potential for reduced returns if the venture is not successful. |

| LLC (Limited Liability Company) | LLP (Limited Liability Partnership) | |

|---|---|---|

| Definition | A business entity that combines the tax benefits of a partnership with the limited liability protection of a corporation. Members are not personally responsible for the company's debts and liabilities. | A partnership where each partner has limited liability for the actions of the other partners. |

| Liability Protection | Members are not personally responsible for the company's debts and liabilities. | Each partner is protected from personal liability for the actions of the other partners. |

| Taxation | Profits and losses are passed through to the members and taxed on their personal income tax returns; however, an LLC can elect to be taxed as a corporation. | Profits and losses are passed through to the individual partners and taxed on their personal income tax returns. |

| Management | Managed by the members, who may have different ownership percentages and share profits and losses according to those percentages. | Managed by the partners, who share profits and losses equally. |

| Formation | Requires registration with the state and filing articles of organization. | Typically requires registration with the state and filing a partnership agreement. |

| Purpose | Popular among small businesses and startups. | Commonly used by professional service firms such as law firms and accounting firms. |

| Merger | |

|---|---|

| Definition | A business transaction in which two or more companies combine into a single entity. Absorption : into an existing company Consolidation : into an new company |

| Type of Merger | Description |

|---|---|

| Horizontal Merger | Two companies that are in direct competition/similar line of activities |

| Vertical Merger | Two companies that are at different stages in the same supply chain merge. The goal is to streamline operations and improve efficiency. |

| Conglomerate Merger | Two companies that are in unrelated industries merge. The goal is to diversify the company's portfolio and reduce risk. |

| Mission Statement | Vision Statement | |

|---|---|---|

| Focuses on the present | Focuses on the future | |

| Describes the purpose and reason for an organization's existence | Describes the desired future state and long-term goals of the organization | |

| Specifies what the organization does, who it serves, and how it serves them | Provides a compelling image of what the organization aspires to achieve | |

| Typically more specific and actionable | Generally broader and more inspirational | |

| Guides day-to-day operations and decision-making | Guides strategic planning and direction | |

| Represents the organization's core values and fundamental beliefs | Represents the organization's aspirations and desired impact | |

| Often remains relatively stable over time | May change or be revised periodically to reflect evolving goals and objectives | |

| Example: "To provide affordable and accessible healthcare services to underserved communities" | Example: "To be the global leader in sustainable technology innovation, transforming industries and improving lives" |

- Business Environment : Business environment is composed of elements that have impact on business operation in an organization

- Internal Environment: factors within the business boundaries

- Employees

- Policies

- Decision Making

- Board of directors

- Process

- Rules

- Strategy

- Internal Environment: factors within the business boundaries

- Political

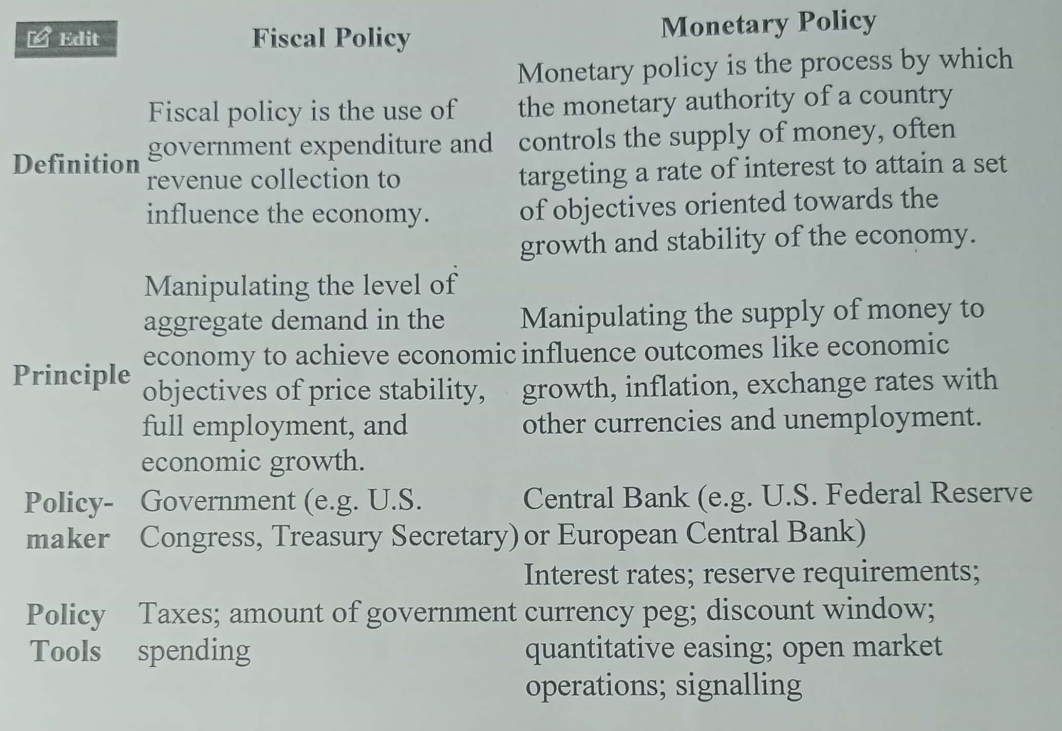

- Monetary and Fiscal Policy

- Export and import policy

- industry policy

- tax framework

- social program

- Government system

- Government policy

- Public opinion

- Freedom of press

- Corruption level

- Economical

- Growth, inflation and exchange rate

- monetary and fiscal policy

- business cycle stage

- Recovery

- Prosperity → Peak, boom

- Recession

- Depression

- unemployment, labor supply and labor cost

- globalization and openness of economy

- government regulation and taxation

| Porter's Five Forces | Description |

|---|---|

| 1. Threat of New Entrants | Examines the potential for new competitors to enter the industry and disrupt existing businesses. Factors such as barriers to entry, economies of scale, and access to distribution channels are considered. |

| 2. Bargaining Power of Suppliers | Analyzes the influence suppliers have over the industry in terms of pricing, quality, and availability of inputs. Factors such as the number of suppliers, uniqueness of their products, and switching costs are taken into account. |

| 3. Bargaining Power of Buyers | Assesses the power customers have to negotiate prices and terms. Factors such as the concentration of buyers, availability of substitutes, and their price sensitivity are considered. |

| 4. Threat of Substitute Products or Services | Looks at the potential for alternative products or services to meet the same needs as the industry's offerings. Factors such as the availability of substitutes, their price-performance ratio, and customer loyalty are examined. |

| 5. Intensity of Competitive Rivalry | Evaluates the level of competition within the industry. Factors such as the number and size of competitors, market growth rate, and industry consolidation are taken into consideration. |

Macro environment : those environment which have indirect/distant impact on the business operation

- PESTLE

- Definition:

- Political

- Economic

- Social

- Technological

- Legal

- Ecological

- Importance

- an organization become more globalized

- expanding their boundaries

- entering in the new market with/ not new product

- Process

- Brainstorm and list key issues

- Broadly identify the implication of each issue

- Rate it’s relatively important

- Rate it’s likelihood of it occurring

- Briefly consider the implications if the issue did occur

SWOT analysis: is a structured method used to evaluate the strengths. weakness, opportunities and threads of a business organization

Term Definition Asset A resource with economic value that is owned or controlled by an individual or entity.

Assets can be tangible, such as cash, inventory, or property, or intangible, such as patents or trademarks. Assets represent what an entity owns.Liabilities Debts or obligations owed by an individual or entity to external parties.

These can include loans, accounts payable, or any other financial obligations. Liabilities represent what an entity owes to others.Owner's Equity The residual interest in the assets of an entity after deducting liabilities. It represents the owner's claim on the business and is calculated as the difference between assets and liabilities. Owner's equity can also be referred to as shareholders' equity in the case of a corporation or simply equity in the case of a sole proprietorship.

- Definition: